When to stop the "lack of core": Enlightenment from the financial report of semiconductor enterprises

Time:2022-08-08

Views:1775

Source: core myna Author: Justin

The sudden COVID-19 epidemic has brought a great impact on the global economy in the first half of 2020. The GDP of major economies in a single quarter has fallen to varying degrees, or even negative growth. In the second half of 2020, the global economy ushered in a recovery, and the most striking one was the outbreak of the new energy automobile industry. However, the ensuing test on the supply chain has just begun, especially the chip supply chain. After entering the fourth quarter of 2020, until now, for a whole year, "lack of core" and price increase have occupied the hot headlines. Looking back over the past year, it is worth thinking about the reasons for the global "lack of chips". Let‘s take a look at what happened on the supply side and the demand side of chips.

First, let‘s talk about the supply side. First, the impact of the epidemic. On the one hand, the epidemic disrupted the production capacity of some semiconductor manufacturers. For example, the capacity expansion plan of chip manufacturer NXP; On the other hand, the epidemic has repeatedly hit semiconductor factories in some areas. For example, the epidemic in Southeast Asia in August this year. Another factor on the supply side is that most of the high-end chip production capacity is concentrated in the hands of TSMC, Samsung and other wafer manufacturers. The capacity of these manufacturers is already at full capacity, and there is no standby capacity. The new capacity will not be put into production until the second half of 2022 or even 2023, which is far from being hydrolyzed.

The first outbreak point on the demand side is the normalization of people‘s home work and online learning due to the impact of the epidemic. In 2020, the sales of notebook computers, home network devices and displays reached the highest level in the past decade, which led to a significant increase in chip demand. The second explosive point is the rapid rise of new energy vehicles. The number of chips in traditional cars is about 500-600. With the increase of automatic driving, new energy and other functions, the number of chips now is about 1000-1200. However, some intelligent models require more chips. This is the increment of a single vehicle, but what is more surprising is the explosive growth of sales. According to the data released by the China Federation of passenger cars, the wholesale and retail sales of new energy vehicles in China from January to September 2021 were 2.023 million and 1.818 million respectively, with year-on-year growth rates of 218.9% and 203.1% respectively. The sales volume of the whole industry is doubling. It can be imagined how much demand there is for chips.

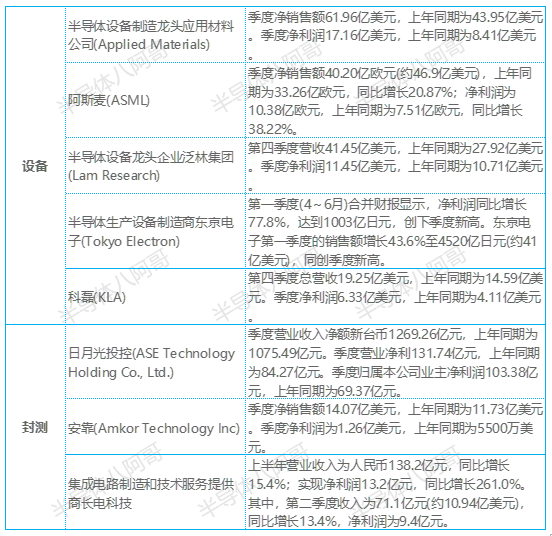

Since there is such a shortage of chips and accompanied by rounds of price increases, what will be the performance of semiconductor manufacturers? The following figure is a summary of the financial statements of 33 semiconductor enterprises in the world in the second quarter of 2021:

First, let‘s talk about the supply side. First, the impact of the epidemic. On the one hand, the epidemic disrupted the production capacity of some semiconductor manufacturers. For example, the capacity expansion plan of chip manufacturer NXP; On the other hand, the epidemic has repeatedly hit semiconductor factories in some areas. For example, the epidemic in Southeast Asia in August this year. Another factor on the supply side is that most of the high-end chip production capacity is concentrated in the hands of TSMC, Samsung and other wafer manufacturers. The capacity of these manufacturers is already at full capacity, and there is no standby capacity. The new capacity will not be put into production until the second half of 2022 or even 2023, which is far from being hydrolyzed.

The first outbreak point on the demand side is the normalization of people‘s home work and online learning due to the impact of the epidemic. In 2020, the sales of notebook computers, home network devices and displays reached the highest level in the past decade, which led to a significant increase in chip demand. The second explosive point is the rapid rise of new energy vehicles. The number of chips in traditional cars is about 500-600. With the increase of automatic driving, new energy and other functions, the number of chips now is about 1000-1200. However, some intelligent models require more chips. This is the increment of a single vehicle, but what is more surprising is the explosive growth of sales. According to the data released by the China Federation of passenger cars, the wholesale and retail sales of new energy vehicles in China from January to September 2021 were 2.023 million and 1.818 million respectively, with year-on-year growth rates of 218.9% and 203.1% respectively. The sales volume of the whole industry is doubling. It can be imagined how much demand there is for chips.

Since there is such a shortage of chips and accompanied by rounds of price increases, what will be the performance of semiconductor manufacturers? The following figure is a summary of the financial statements of 33 semiconductor enterprises in the world in the second quarter of 2021:

Semiconductor eight elder brother content team arrangement

On the whole, the performance of comprehensive enterprises, design, OEM, equipment, seal testing and other enterprises has achieved different levels of growth. From the perspective of comprehensive enterprises, compared with the same period last year, Samsung, Hynix, micron, Texas Instruments, STMicroelectronics, microchip technology, and Cisco all achieved substantial growth or even doubling, and Infineon, NXP, and Anson achieved a turnaround. From the financial reports of these 33 world-renowned semiconductor enterprises in 2021q2, it seems that everyone is in the semiconductor business cycle.

According to the financial report of SK Hynix, the demand for DRAM and niche DRAM for computers and graphics cards has been greatly increased with the release of the restrained consumption demand for the normalization of non-contact life under the epidemic. The sales volume of the second generation 10 nanometer level DRAM, 128 layer NAND flash memory and other cutting-edge products increased, thus the cost competitiveness of the company was improved. This further corroborates the performance growth driven by the "lack of core" caused by the soaring demand under the epidemic

Then, what will the "lack of core" and "price increase", or the semiconductor business cycle, be reflected in the business of these semiconductor enterprises? Let‘s take automotive semiconductor enterprises as an example to dig deep into their financial reports.

Dig deep into the financial reports of automotive semiconductor manufacturers: the impact of "lack of core" diminishes marginally

According to the statistics of auto forecast solutions, as of August 9 this year, the global production reduction caused by chip shortage has reached 5.85 million vehicles. Among them, the production of the Chinese market was reduced by 1.122 million. It is expected that the global automobile production will decrease by more than 7 million in 2021. Why did this happen? What kind of existence is the chip in the automobile industry? It is estimated that the average number of semiconductors carried by each vehicle is about 1600. These semiconductor devices are distributed in various equipment and systems of the vehicle. It is the automotive chips, such as logic computing chips, memory chips, and microcontroller MCU, that lead their cooperative work. From the perspective of application, all kinds of chips can not be separated from the small tire pressure monitoring system (tmps) and camera, the large vehicle controller and the automatic driving domain controller. It can be said that the intelligence of the automobile is the intelligence of the chip.

Let‘s return to the financial reports of the major automobile chip enterprises.

Semiconductor eight elder brother content team arrangement

Qualcomm: QCT revenue in Q1 was US $6.28 billion, including US $240 million for automobiles, an increase of 40% year-on-year; QCT revenue in the second quarter was 6.47 billion US dollars, including 250 million US dollars for automobiles, with a year-on-year increase of 83%, which was quite strong. Qualcomm‘s advanced process chips have only two OEM partners, TSMC and Samsung. The low-end 0.18 micron power management chips are mainly manufactured by SMIC. TSMC is the first choice of Qualcomm. In the advanced process, TSMC accounts for about 70%. However, TSMC‘s production capacity is too tight. Apple takes over the production capacity of 4 nm and 5 nm, and even big customers such as Qualcomm cannot squeeze in. Qualcomm is deeply affected by the lack of OEM capacity, and its recent major move is to adopt Intel as its new OEM partner.

Intel Mobileye: Intel‘s automotive business is mainly divided into two parts: one is the acquired Mobileye and the other is the cockpit SOC, that is, atom a3900 series products, which is subordinate to Intel‘s IOT business department. In the second quarter, the revenue of Mobileye fell by 13.3% month on month. Although the year-on-year growth rate was still high, Mobileye seemed to have reached the ceiling. In terms of operating profit, the operating profit of Mobileye in the second quarter was US $109 million, down 25.9% month on month. Considering that the main product Mobileye occupies about 75% of the ADAS market, it is facing competition from NVIDIA, anba, Texas Instruments, Qualcomm and Xilinx FPGAs, especially NVIDIA and FPGAs. The IOT business unit of Intel Atom a3900 series performed well, with a year-on-year increase of 46.9% in the second quarter and a sharp increase of 310% in operating profit. Recently, the a3900 series cockpit SOC shipment is booming, and the big customer BMW is outshining others.

NXP: the revenue of NXP automobile business increased by 87% year-on-year and 3% month on month in the second quarter of 2021. It reached a record high for NXP, with an increase of 22.4% compared with the second quarter of 2019, which may be mainly due to the increase in product prices. With such beautiful performance in the second quarter, NXP also made very good forward-looking guidance for the third quarter in its financial report. In terms of products, the NXP automotive field includes s32g2 and s32r294. S32g2 is the latest 16 nm gateway processor of NXP and the most advanced product of NXP manufacturing process. S32r294 is a chip for 4D millimeter wave radar, with an on-chip SRAM of 6.5mb and a new mipi-csi2 interface. These two chips are manufactured by TSMC.

Infineon: a large part of Infineon‘s back-end production capacity is located in Malaysia, which is seriously affected by the Southeast Asian epidemic. In the first quarter of 2021, Infineon‘s automobile business income increased by 45% year-on-year and 6% month on month. Operating profit increased by 302% year on year. In the second quarter, Infineon‘s revenue fell slightly on a month on month basis, and it appeared to be different in the great development of automobile chips, which was mainly affected by the epidemic. However, the impact of the epidemic in the third quarter may be more serious. Infineon has increased the proportion of entrusted manufacturing. Fortunately, the automobile business only accounts for 43% of Infineon‘s overall income, and other businesses are basically unaffected According to the forward-looking guidance of the third quarter, Infineon still expects the overall revenue to increase from 2.7 billion euros to 2.9 billion euros month on month. Infineon monopolizes the IGBT supply of major electric vehicle enterprises in China, including GAC‘s main aion s, the latest Xiaopeng P5 and SAIC mingjue ezs. Infineon has a market share of more than 60% in China. Infineon almost monopolizes the domestic electric vehicle chassis MCU, and the supply of Infineon MCU will be short, which will affect the domestic electric vehicle manufacturers, especially small manufacturers.

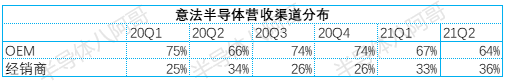

St semiconductor: it is not easy for St semiconductor‘s automobile based ADG business unit to grow by 3.3% month on month in the second quarter. The main reason is that the dealers have increased their purchasing efforts to stock more chips. In the first quarter of 2021, the proportion of dealers increased significantly by 7 percentage points to 33%, and continued to increase to 36% in the second quarter. Dealers have tasted the sweetness of hoarding and kept increasing the intensity of hoarding. Compared with the second quarter of 2019, the revenue of St ADG business unit increased by 21.7%, and the operating profit increased by 39.7%. St ADG business unit is also in the best period in history. The forward-looking guidance for the third quarter is also very good. It is expected that the overall median revenue will be US $3.2 billion, an increase of 7% month on month. ST is the exclusive supplier of Mobileye in addition to eyeq5. It manufactures chips for Mobileye and is also the exclusive supplier of Tesla SiC MOSFET.

Semiconductor eight elder brother content team arrangement

Reza: in 2020, the auto business income of Reza was 341 billion yen (equivalent to US $3.19 billion), down 6.2% from 2019. The revenue of Renesas automotive semiconductor business increased by 12.2% in the second quarter of 2021 compared with the second quarter of 2019. Rissa is very optimistic about the third quarter. The forward-looking guidance is that the month on month growth is 10.2%, and the year-on-year growth is 34.3%. It is expected that the month on month growth of the auto business will exceed 10%, and the demand is very strong, mainly due to the brilliant performance of Japanese cars, which drives the performance of Rissa to soar. Rissa and NXP are the world‘s largest automobile MCU manufacturers, and 80% of the car cockpit uses Rissa‘s MCU. In addition, in the field of traction motor drive, battery management and inverter, the MCU market share of Renesas also exceeds 60%. The large increase in the sales of electric vehicles is also one of the reasons for the substantial increase in the orders of renesa.

On the whole, in addition to Infineon suffering from the Malay epidemic, the performance of major auto semiconductor manufacturers is very good, and the marginal impact of "core shortage" is gradually weakening.

Hoarding is just a surface, beware of crazy production expansion plans

As shown in the financial report of Ruyi semiconductor, the continuous hoarding of goods by channel operators for several quarters has exacerbated the problem of "core shortage" and price rise in the market

In fact, in June this year, Tesla founder musk also commented on the phenomenon of chip shortage in his tweet, pointing out that he had never seen such a thing before. The industry was worried about using up its inventory and placing excessive orders, just like worrying about hoarding without toilet paper.

The rise in the price of chip hoarding has attracted the attention of the government, and China and the United States have taken turns to stop it.

In August this year, the General Administration of Market Supervision announced that in view of the prominent problems of the auto chip market, such as the speculation and high prices, the General Administration of market supervision will, according to the price monitoring and reporting clues, file a case against the auto chip distribution enterprises suspected of raising prices. On September 10, the General Administration of market supervision and administration of the people‘s Republic of China imposed a fine of 2.5 million yuan on the three automobile chip distributors for raising the price of automobile chips. The three distribution enterprises of Shanghai qiete, Shanghai Chengsheng and Shenzhen Yuchang greatly increased the price of some auto chips. For example, chips with a purchase price of less than 10 yuan were sold at a high price of more than 400 yuan, up 40 times.

In late September, the US Department of commerce also focused on the stock problem, criticizing the "low transparency" of the semiconductor market, and even requiring large semiconductor manufacturers such as TSMC, UMC, Samsung and SK Hynix to disclose their inventory, sales data and orders within 45 days in response to the questionnaire, so as to clarify and solve the supply chain bottleneck caused by the shutdown of US automobile manufacturers and the shortage of consumer electronic products.

In an interview with time in early October, Liu Deyin, chairman of TSMC, said that many car companies directly pointed the source of chip shortage at TSMC. However, after understanding the real needs of customers through the mechanism of triangular different data, it was observed that "in the supply chain of automotive chips, there must be some people hoarding goods", which was not entirely the problem of chip OEM production.

Generally speaking, the price increase of the original chip manufacturer will be publicized, and the price increase range is limited. And under the condition of balanced supply and demand, the markup rate of auto chip traders is generally 7% ~ 10%. However, the current chip price rise has made most auto suppliers face the pressure of chip price rise by 10-20 times. The reason is the speculation of distributors.

The problem of chip hoarding tests the control of major terminal manufacturers on their own supply chain, and also encourages many terminal manufacturers to start the pace of chip self-development, especially in areas such as automatic driving

However, the author believes that the impact of the Chinese and American governments on the hoarders is more symbolic than practical, because the essence of hoarding lies in the shortage of production capacity, which is the role of industrial forces. The hoarders are only helping the rise and fall. Only by truly solving the problem of production capacity shortage can we effectively curb hoarding. However, as the above analysis shows, the second quarter financial report data shows that the performance of major manufacturers has taken off, and the marginal impact of "core shortage" is gradually weakening. With the recovery of production capacity of major manufacturers, it is not ruled out that subsequent stockers may start to sell.

At present, the wafer capacity expansion plans of major manufacturers are very large, and the potential overcapacity caused by them must be paid attention to. According to semi‘s latest forecast, during 2021-2022, 29 new wafer factories will be built in the world, and the total equipment expenditure will exceed 140 billion US dollars (907.9 billion yuan). Among them, 19 new wafer plants will be built in 2021 and 10 new wafer plants will be built in 2022. It is worth noting that while countries are increasing their investment in the semiconductor industry, the analysis institutions have also issued a warning that how much investment is now, how strong the scale of production expansion is, and how serious the situation of oversupply will be in a few years, which is very alarming.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is infringement or objection, please contact us to del |