The demand for car regulation chip is booming! These IDM manufacturers are full of orders in 2023

Time:2022-12-09

Views:1330

Introduction: The "core shortage tide" that lasted for two years is gradually fading, but the structural core shortage is still continuing, such as the shortage of car chips. Previously, the industry predicted that the car core shortage would ease in 2023, but the situation was still severe. As cars have become the fastest growing field of semiconductor demand in recent years, "Shangche" has also become a new growth engine pursued by domestic chip manufacturers.

Today, according to the Taiwan, China Electronic Times, insiders pointed out that although some IDM factories have recently made adjustments to vehicle chip items, overall, the total transaction value of long-term contracts has basically remained unchanged, and estimates are only structural adjustments. Looking forward to the demand for vehicles in 2023, it is still optimistic. Some IDM factories made a statement in the middle of the year that their orders in 2023 were full.

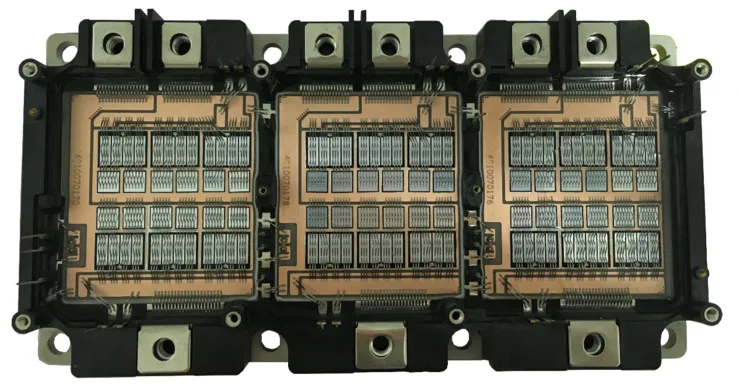

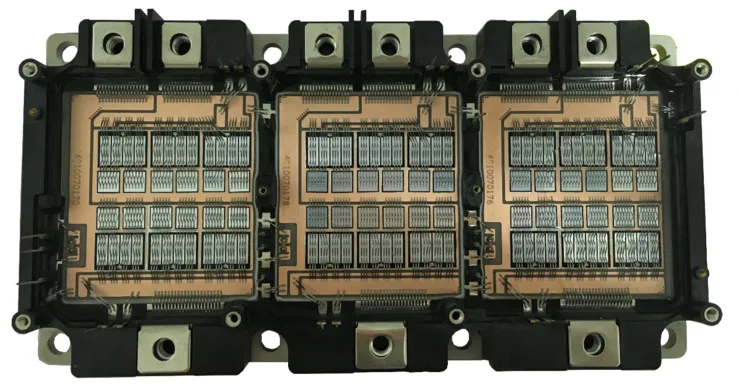

For example, although the semiconductor cycle has undergone periodic adjustment, it has benefited from the demand for new energy vehicles, new energy power generation, etc., and the power devices represented by IGBT (Insulated Gate Bipolar Transistors) have grown strongly. IGBT companies related to A-share have a full order volume, and the production capacity is in short supply.

Source: Network

As the leader of IGBT, Star Semiconductors achieved a net profit of 590 million yuan in the first three quarters of this year, an increase of 1.21 times over the same period last year. The growth rate exceeded the operating income, and the gross profit margin of sales reached 41.07%, a month on month increase.

On December 5, at the third quarter performance presentation meeting of Startech Semiconductors, executives of the company introduced that the main driving force for the growth of revenue in recent quarters was the continuous and rapid expansion of the company‘s products in new energy vehicles, photovoltaic, energy storage, wind power and other industries, and the market share continued to increase; With the release of scale effect, optimization of product structure, and improvement of production and operation efficiency, the gross profit margin of the Company has continued to grow.

From the perspective of income structure, from January to September, the revenue from new energy industry (including new energy vehicles, new energy power generation and energy storage) accounted for more than half of the total revenue of Starr, which became the main driving force for the company‘s performance growth.

IGBT peer macro and micro technology also benefited from the development of the new energy market. In the first three quarters of this year, the company achieved a net profit of 61.25 million yuan, an increase of about 30% year on year; Among them, in the third quarter, it achieved 29.01 million yuan, nearly doubling the year-on-year growth. The gross profit rate of sales was 21.77%, about half of that of Starr.

In addition, in the first three quarters of this year, the company realized a net profit of 774 million yuan, a year-on-year increase of 6.43%; When receiving the agency‘s research recently, the senior executives of Shilan WeChat expected that the company‘s revenue in the fourth quarter was expected to be stable and upward, and the new energy products of automobiles had gradually met the conditions for a large number of shipments.

It is worth noting that the storage giants continue to increase the car storage market, and the car track is warm in the "cold winter of storage". Samsung, Micron, Huabang, Wanghong, Nanya Branch and other mainstream manufacturers of memory chips have launched corresponding automotive storage products.

According to Meguiar‘s estimation, the DRAM and NAND required by fully autonomous vehicle are 30 and 100 times that of non autonomous vehicles.

China is the world‘s largest consumer of memory chips. However, due to the relatively limited scale of the car storage track and the long cycle of vehicle specification level R&D, certification and testing, there is no chip/module company specializing in this track in China.

Hua‘an Securities believes that despite the high barriers to the track of vehicle regulation level storage, the proportion of localization will continue to increase. It is suggested to focus on Beijing Junzheng and Zhaoyi Innovation, which have experience in product shipment, and Dongxin Shares, which recently entered the field of vehicle storage. In terms of storage modules, it is recommended to focus on Jiangbolong and Baiwei Storage.

On the other hand, a few days ago, Taiwan, China Economic Daily reported that a number of car manufacturers have recently announced to increase the price of new cars. The industry pointed out that the soaring cost of raw materials is one of the factors for the price increase, but the serious shortage of new car supply caused by chip shortage is the key to the price increase of the original factory. When can the chip shortage be alleviated? According to the relevant information of manufacturers, there will be opportunities to improve at least until the middle of next year. Toyota‘s internal information is that the vehicle supply will still be insufficient in 2023. Another car manufacturer said that the supply of car chips is still insufficient, and it is expected that there will be more sufficient supply after 2024.

Moreover, the latest news shows that Kristin Dziczek, policy adviser of the Federal Reserve Bank of Chicago, wrote a report on the problem of automobile chip production capacity. The report believes that the shortage of automobile chips is still continuing and is expected to continue until 2024.

Dziczek believes that the shortage of automotive MCU will last until 2024, which is consistent with other predictions of industry insiders. The typical representative is Pat Gelsinger, CEO of Intel. The shortage may last beyond 2024.

In retrospect, a report released by Alex Partners, an American consulting agency, at the beginning of last month showed that the restriction of chip shortage on German automobile production would "last at least until 2024". According to the German news agency, at this stage, it takes six months from ordering to delivery, twice the normal time.

The report, prepared by industry experts, said: "With the continuous development of digitalization and electrification, the demand for chips for each car continues to increase. However, affected by the economic downturn and rising interest rates, semiconductor manufacturers are self restraining capacity expansion."

The profit margin of traditional automobile chips is up to 11 percentage points lower than that of chips used by consumer electronics or industrial customers. From the perspective of chip manufacturers, the automotive industry is "just a small customer of semiconductor chips", accounting for 6% to 10% of the global chip production capacity. The report analyzes that "chip production is still the bottleneck of the automobile industry". By 2024, the chip will still be in short supply, and the price rise will eventually drive up the car sales price.

The report predicts that by 2026, the demand for chips in the automotive industry will increase significantly; The demand for analog chips for electric drive will increase by 75%, and the chips for microcontrollers will increase by 30%. However, chipmakers intend to increase their capacity in these areas by only 56% and 12% respectively.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |