SMIC International‘s 2022 performance hit a new high. It is expected that the gross profit margin of 20 this year will be roughly the same as capital expenditure

Time:2023-04-01

Views:1003

Source: Science Innovation Board Daily

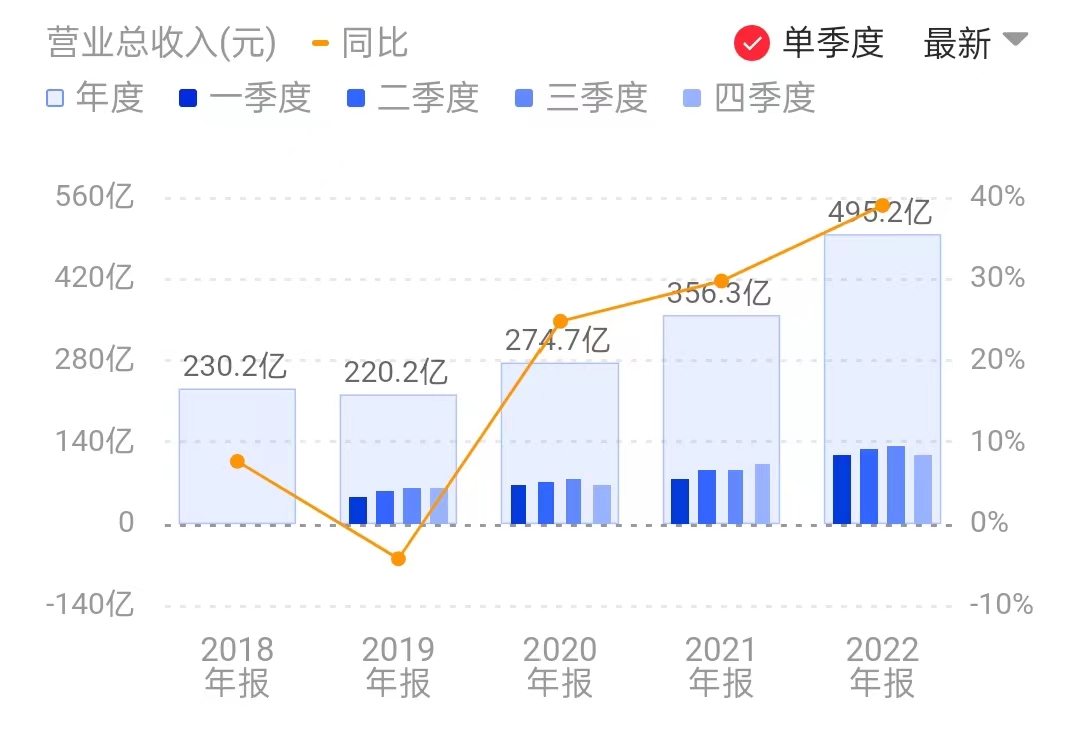

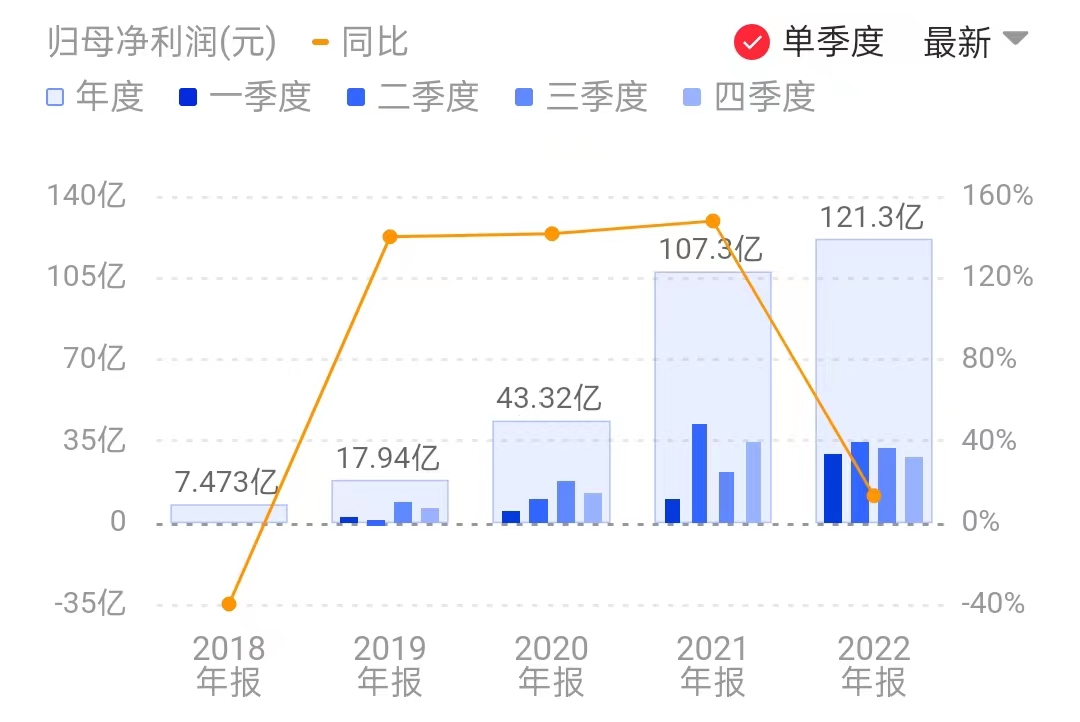

SMIC International disclosed its performance in 2022 after market today. In 2022, the company achieved operating revenue of 49.516 billion yuan, a year-on-year increase of 39%; Net profit was 12.133 billion yuan, up 13% year-on-year; The net profit after deduction was 9.764 billion yuan, an increase of 83.4% year-on-year; Basic earnings per share are 1.53 yuan.

Judging from its historical performance, its annual revenue and net profit have reached record highs.

SMIC International Revenue

Net profit of SMIC International

In 2022, SMIC International‘s gross profit margin increased by 9 percentage points year-on-year to 38.3%; Net interest rate decreased by 1.8 percentage points year-on-year to 29.6%.

SMIC International said that its revenue and net profit growth was mainly due to an increase in the number of wafers sold and an increase in average selling prices; The decrease in net interest rate was mainly due to a decrease in income from investments in associates, fund portfolios, and equity financial assets.

In terms of research and development, SMIC International‘s research and development investment in 2022 totaled 4.953 billion yuan, an increase of 20.2% year-on-year. The proportion of research and development investment in revenue decreased by 1.6 percentage points to 10% year-on-year.

In terms of research and development projects, in 2022, the 28 nm high-voltage display drive process platform, the first stage of the 55 nm BCD platform, the 90 nm BCD process platform, and the 0.11 micron silicon based OLED process platform have completed research and development, and entered small batch trial production.

Automotive electronics has become its key research and development field. Among the nine projects under research disclosed by SMIC International, four are used in the automotive field, including the 40 nm embedded storage technology automotive platform project, the 4X nm NOR Flash technology platform project, the 55 nm high-voltage display drive automotive technology platform project, and the 0.13 micron EEPROM automotive electronics platform research and development project.

Looking forward to 2023, SMIC International maintains a cautious and optimistic attitude, striving to stabilize production capacity and capital expenditure at the level of 2022.

When it comes to capital expenditure, its capital expenditure in 2022 is about 43.24 billion yuan, mainly used for capacity expansion and new plant infrastructure. SMIC International expects that its capital expenditure in 2023 will be roughly the same as in 2022, exceeding 10% of the company‘s latest audited net assets, and the capital demand is large. Therefore, it is not planned to conduct profit distribution in 2022.

From the demand side, the company stated that the recovery of the smartphone and consumer electronics industry takes time, and the industrial sector is relatively stable. Incremental demand in the automotive electronics industry can only partially offset the negative impact of the weakness of mobile phones and consumer electronics. In the first half of the year, the industry cycle was still at the bottom, and the impact of external uncertainties remained complex. Although the visibility in the second half of the year is still not high, the company has experienced a slight rebound in customer confidence and a relatively full reserve of new product streamers.

Regarding performance and production capacity, SMIC International stated that based on the relatively stable external environment and in accordance with international financial reporting standards, it is expected that the year-on-year decrease in revenue for the entire year of 2023 will be 10 digits lower, with a gross profit margin of around 20%; Depreciation increased by over 20% year-on-year; By the end of the year, the monthly production capacity increment was similar to that of the previous year.

SMIC International stated that during the continuous investment process, the gross profit margin is under high depreciation pressure, and the company will always aim to achieve continuous profitability, strive to grasp the pace of capacity expansion, and ensure a certain level of gross profit margin.

In addition, with the continuous emergence of new application fields such as the Internet of Things, artificial intelligence, and cloud computing, the hot areas for the development of the chip industry are constantly enriched. The broad market prospects and relatively favorable industrial policies have attracted many domestic and foreign integrated circuit related enterprises to layout the integrated circuit wafer foundry industry, which may lead to further intensification of market competition.

Overall, with the continuous growth of global wafer foundry capacity, local industrial chain coordination, operational cost control, technical competitiveness, and R&D resource allocation will become the focus of future development of the global wafer foundry industry.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |