Analysis of the reasons for the shutdown of passive component giant factories and their industrial impact

Time:2024-02-25

Views:272

Source: Octopus Core Author: Joey

Billion dollar passive component giant - Murata

Japan has always been a major supplier and exporter of passive components globally, but due to its location at the junction of multiple geographical plates, it is often susceptible to the impact of uncontrollable natural disasters such as earthquakes.

1. Reason for suspension of work: Japan earthquake, Murata damaged

On January 1, 2024, a 7.6 magnitude earthquake occurred on the Neden Peninsula in Ishikawa Prefecture, Japan, causing damage to multiple electronic component manufacturers in the industry. Among them, the most affected is the passive component manufacturer Murata Manufacturing Company. According to Murata, the earthquake affected the work and life of 13 factories and 13000 employees and their families in the three counties of Beilu.

After a period of recovery, as of January 19th, according to the latest announcement released by Murata, 9 out of 13 factories have resumed production, while 3 factories that have been severely affected are still in a state of shutdown. Among them, including the production of ceramic filters and other products, the Iceman Murata Manufacturing Institute is scheduled to restart production in early February; The resumption of work at Wakura Murata Manufacturing Plant, the manufacturing/research and development base for producing multi-layer resin substrates, is yet to be determined; However, the production of products such as inductors has been severely damaged, and the equipment and factory building are currently undergoing maintenance. It is expected that production will resume in mid May.

As one of the global giants in passive components, the shutdown of some factories at Murata Manufacturing has caused industry insiders to worry that its "butterfly effect" will have a certain impact on the entire industry.

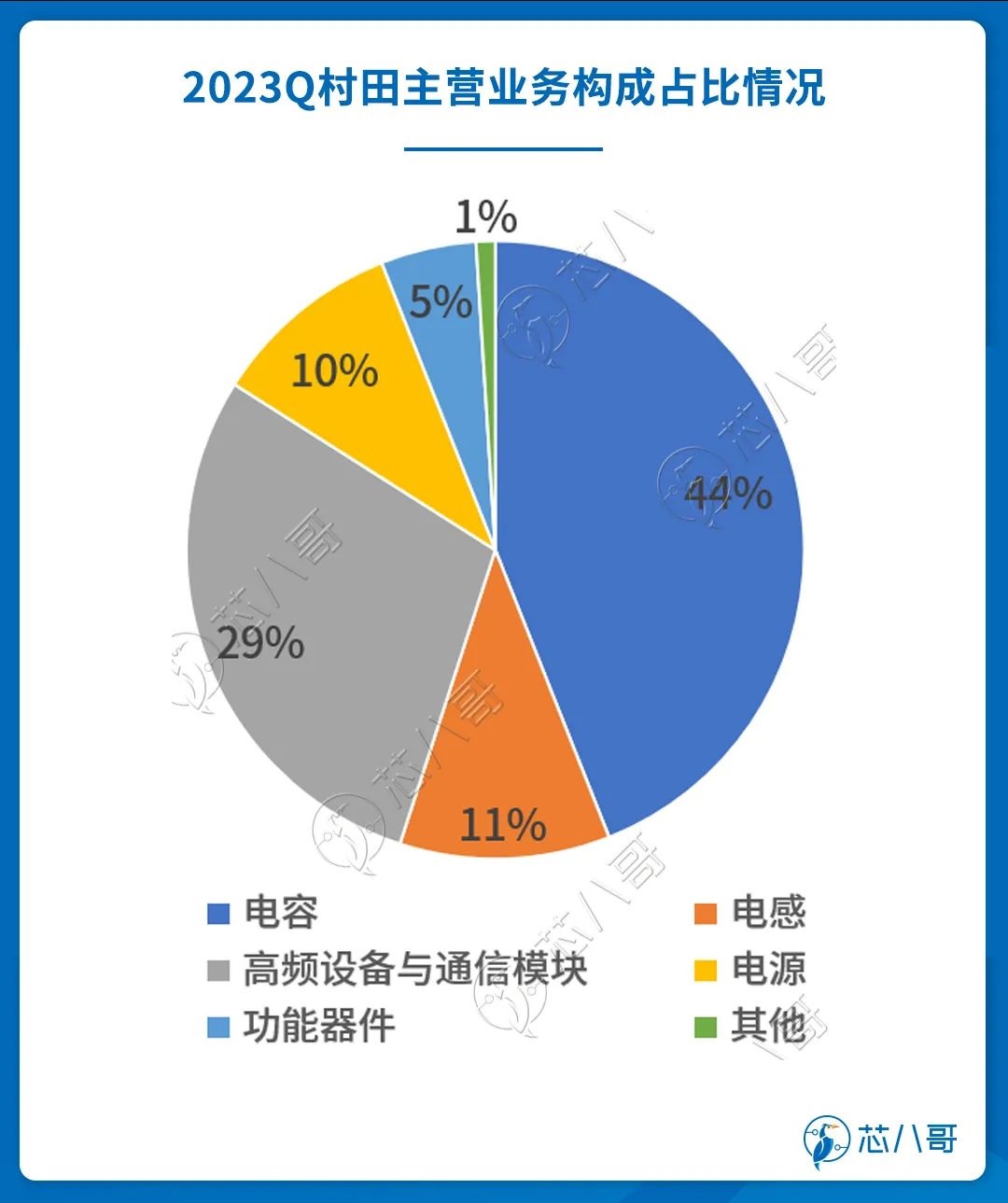

2. Main product lines and corresponding revenue proportion of Murata

From a business perspective, Murata is a global comprehensive electronic component manufacturer mainly engaged in the research and development, production, and sales of electronic components based on capacitors (accounting for about 44%), inductors (11%), power supplies (10%), high-frequency equipment and communication modules (29%), etc. The products are widely used in communication (accounting for 44%), automotive (25%), consumer (20%), industrial (11%) and other fields.

Source: Murata

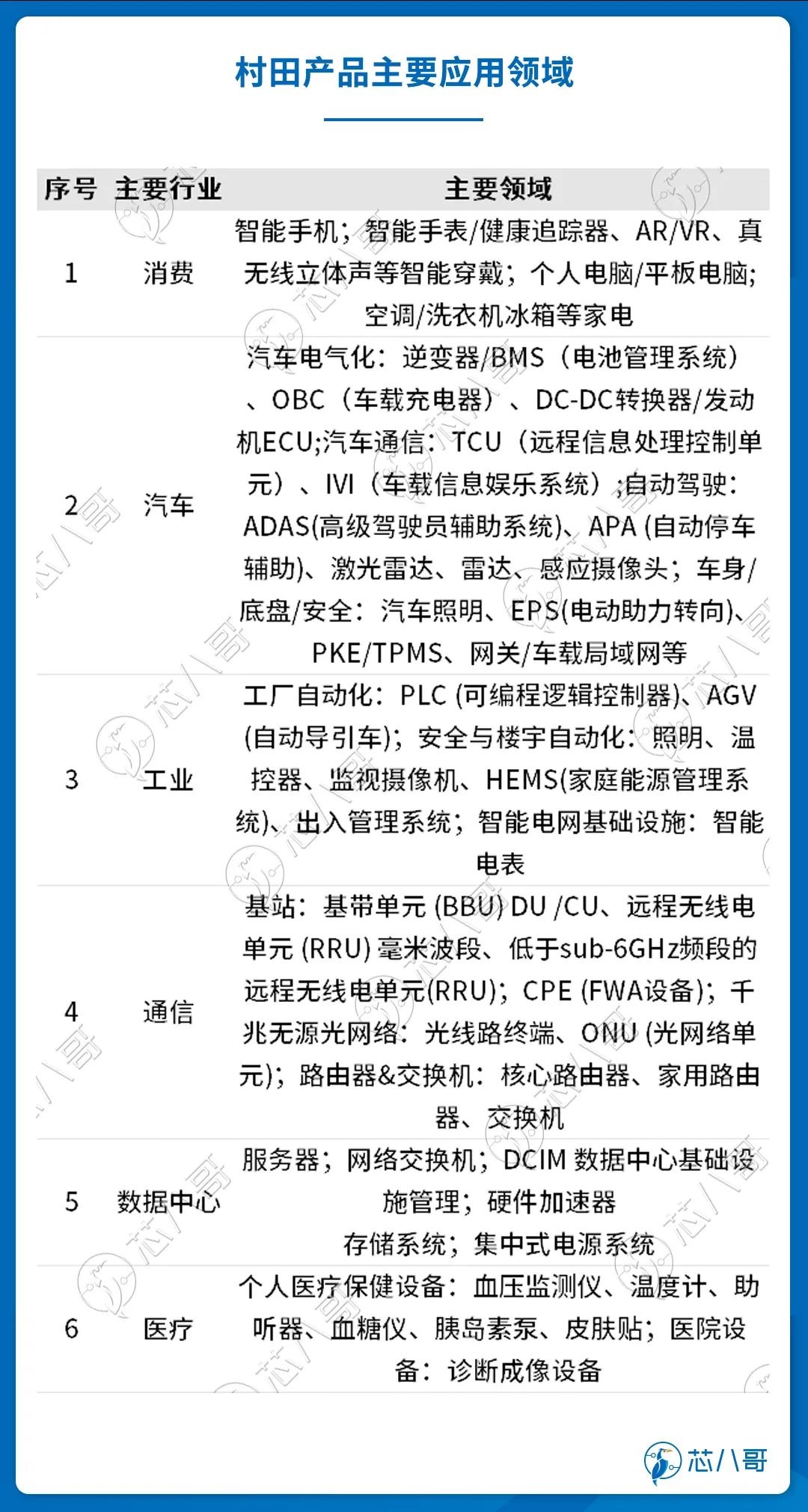

Specifically, in the field of communication, Murata‘s ceramic capacitors, noise reduction filters, and other products are widely used in 5G base stations, gigabit passive optical networks, routers&switches, and other fields. Huawei, ZTE, Datang, and others are all important customers of Murata in the communication field; In the field of mobile phones, Murata has achieved over 50% market share in the 0402M size MLCC commonly used in smartphones through unremitting research on the miniaturization of MLCC. And the 0201M size, 0.1, tailored for 5G phones μ F‘s MLCC has also completed mass production work at Fukui Murata Production, continuously providing support for the miniaturization, multifunctionality, and high-performance of electronic devices for customers such as Huawei, Xiaomi, OPPO, and VIVO; In the automotive industry, as an innovator in the electronics industry, Murata has accumulated over 20 years of rich experience in the field of in car MLCC. The company has launched numerous small, high-capacity, and low inductance car grade products for autonomous driving and electrification, including 1608M, 3216M, 3225M, etc. Its main customers include SAIC, NIO, Tesla, Ideal, and Xiaopeng Motors.

Source: Murata

3. The performance of Murata in recent years

In terms of finance, as a global passive component giant, Murata has been steadily developing in recent years.

Murata‘s performance from 2014 to 2022

Source: Wind

In 2014, the company‘s net profit exceeded the $1 billion mark for the first time; In 2015, the company‘s revenue followed suit and reached the milestone of $10 billion; In 2021, benefiting from the significant growth of the electronics industry as a whole, Murata‘s revenue reached $14.8 billion, with a net profit of $2.6 billion. Both revenue and net profit reached historic highs that year.

Murata‘s revenue and net profit reached a historic high in 2021

Source: Wind

From the above data, it can be seen that as a giant with annual revenue of billions of dollars, every move by Murata may have a certain impact on the entire industry. In fact, industry concerns are not unreasonable. As early as 2017-2018, due to strategic transformation, Murata gradually withdrew some low-end MLCC production capacity, resulting in a supply and demand gap for automotive MLCC and giving rise to the price surge of MLCC in 2017-2018. The price surge subsequently accelerated the certification of some mid to low-end MLCC production lines for vehicles by OEM/first tier suppliers. Similarly, the suspension of production of products such as inductors for about half a year is expected to disrupt the short-term supply-demand balance in the inductance industry, bringing certain market opportunities to the purchasing and selling ends of the industry chain.

Passive component competition pattern: Big performance PK! The Battle of 21 Global Industry Leaders

Passive components are mainly divided into three types: resistors, capacitors, and inductors (also known as RCL devices). Among them, capacitors are mainly used for bypass, decoupling, filtering, and energy storage, accounting for the largest proportion, about 73.2%; The main uses of inductors are filtering, current stabilization, and electromagnetic interference resistance, accounting for approximately 16.7%; And resistors are commonly used for voltage division, shunt, filtering, and impedance matching, with the lowest sales proportion of about 10.0%.

In terms of market size, driven by cloud computing, new energy, automotive electronics, and next-generation communication protocols, passive components have maintained a stable growth trend in recent years. According to Mordor Intelligence, the global passive component market size in 2021 was $32.77 billion, and it is expected to reach $42.82 billion by 2027, with a compound annual growth rate of 4.56% from 2021 to 2027.

In terms of competitive landscape, Japanese, Korean, and Taiwanese manufacturers are currently in a leading position in the passive component industry, balancing technological and production capacity advantages. However, mainland manufacturers are still in the stage of accelerating catch-up.

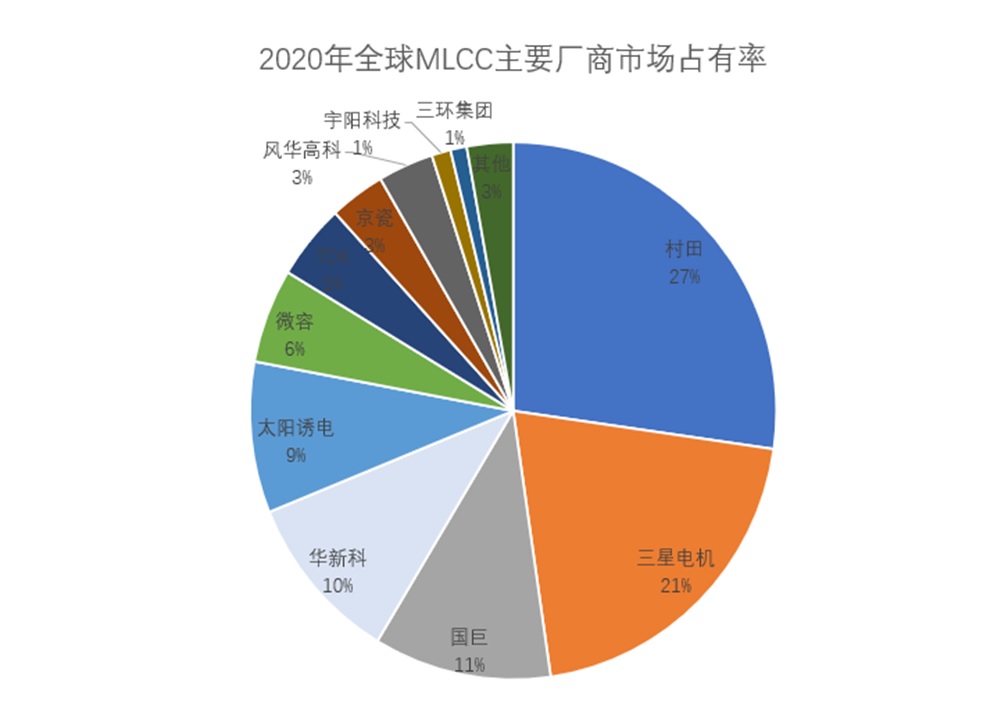

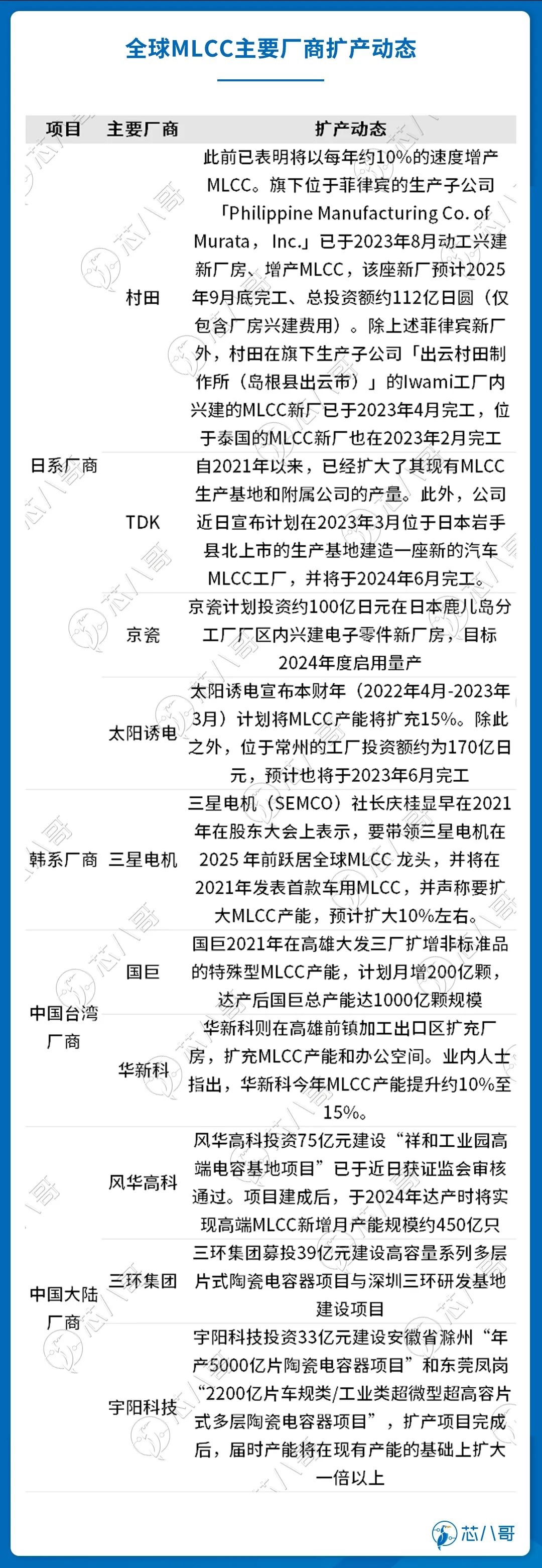

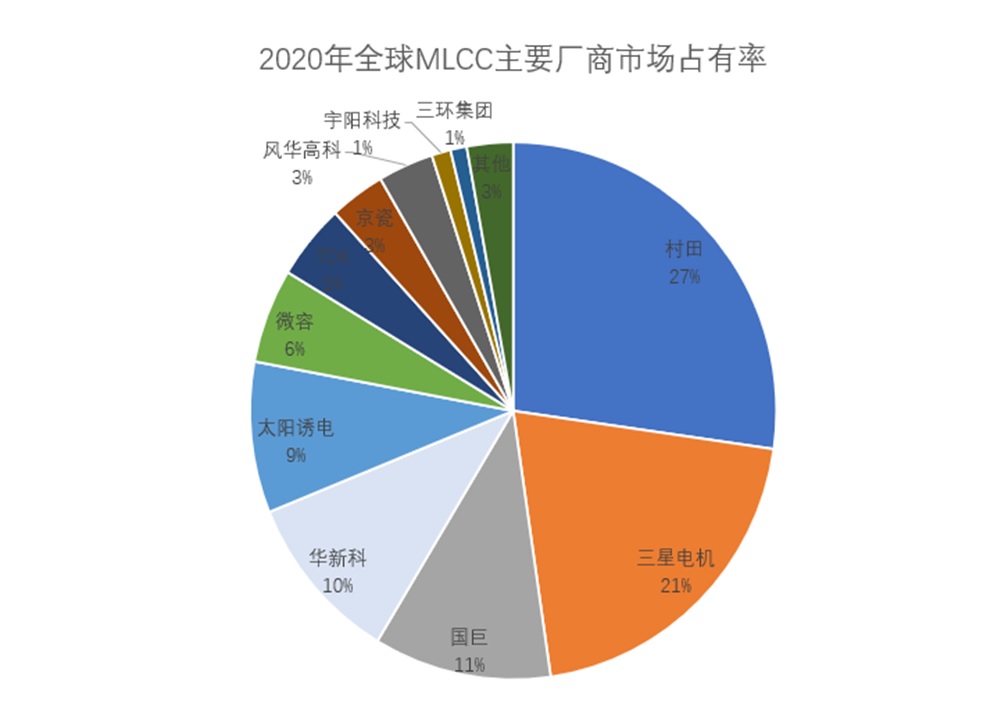

Specifically, in the field of capacitors, MLCC, represented by Japanese companies such as Murata and Sunac, is still in a leading position. Its products cover four areas: small-sized low capacity, small-sized high capacity, large-sized low capacity, and large-sized high capacity, with strong technological and scale advantages; However, South Korean and Taiwan, China enterprises represented by Samsung Electric, Guoju and Huaxinke have large MLCC production capacity, but there is still a gap in technical level compared with Japanese manufacturers; However, Fenghua High tech, Sanhuan Group, Yuyang Technology and other enterprises in Chinese Mainland are currently in rapid development as a whole. Compared with the leading enterprises, the gap in technology and scale has gradually narrowed.

Source: Aibang Zhizao

In the field of resistance, the global chip resistance industry is currently dominated by the United States, Japan and Taiwan, China, of which the United States and Japan are in the leading position in technology, while the manufacturers in Taiwan, China lag behind those in the United States and Japan in technology, but have the advantage of production scale. In terms of specific share, Guoju, a manufacturer in Taiwan, China, occupies the absolute leading position in the market, with a market share of about 34%; KOA, Panasonic and Rohm accounted for 21% of the total market, and Fenghua Hi tech in Chinese Mainland accounted for 6%, ranking fifth in the world.

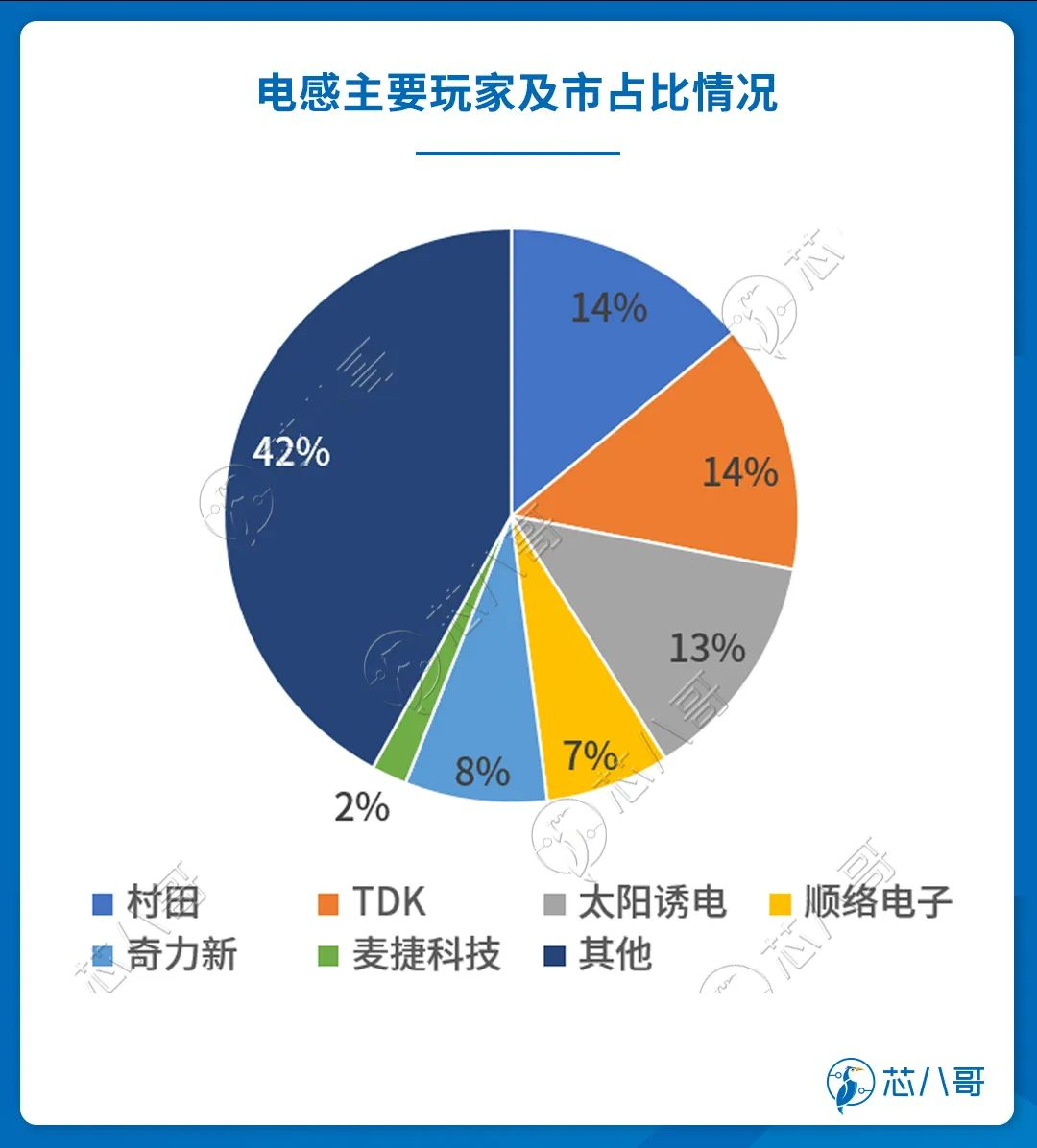

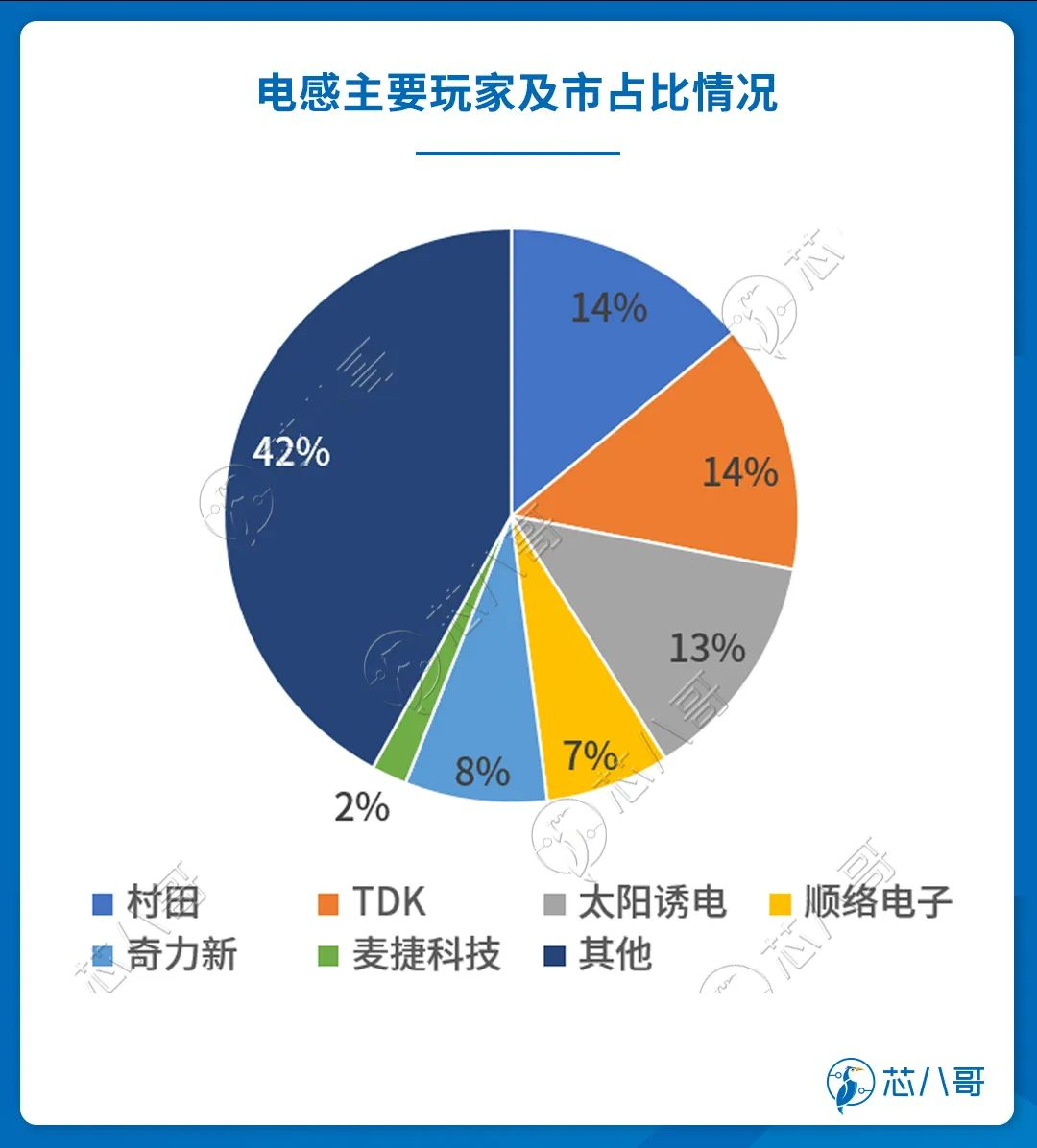

In the field of inductors, Japanese manufacturers currently dominate, with a combined market share of 40-50% for TDK, Murata, and Sunrise; The new market share of Taiwan, China Qili is 8%; In Chinese Mainland, Shunluo Electronics and Maggi Technology are the main inductance fields, which are backed by the domestic inductance demand market. The combined market share of the two is about 10%. In the future, domestic manufacturers are expected to fully leverage their advantages in supporting the industrial chain and further narrow the gap with Japanese manufacturers.

Source: China Electronic Components Industry Association

The competitiveness of passive component manufacturers and the evolution of industry patterns are mainly closely related to the production capacity of each manufacturer. Therefore, in order to maximize the competitiveness and profitability of the company, major companies in the industry have been continuously improving their production capacity in a planned manner in recent years.

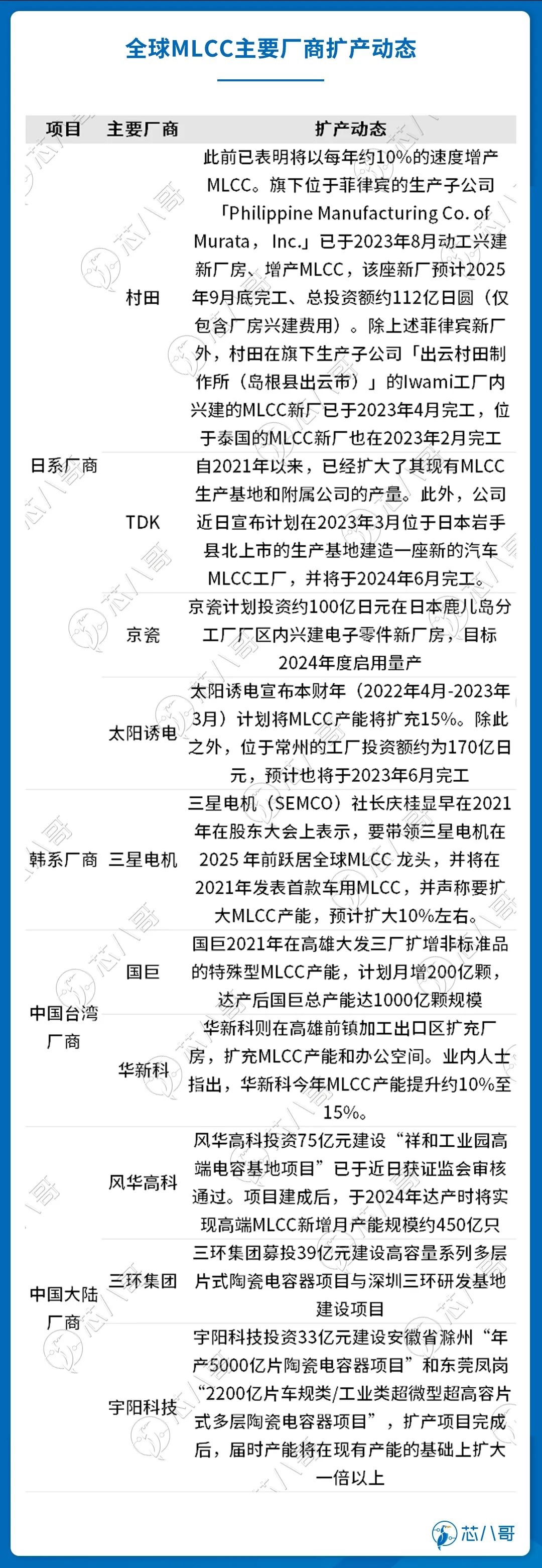

For example, in the MLCC field, Murata City accounts for nearly 30%, with a production capacity of approximately 150 billion vehicles per month. In order to maintain its position, Murata had previously stated that it would increase MLCC production capacity by about 10% annually; Samsung Electric has a market share of 20.45% in South Korea, with a production capacity of approximately 100 billion units per month. The company stated that it will continue to expand its production capacity in the future and lead Samsung Electric to become the global leader in MLCC by 2025; In addition, Guoju, Huaxinke, a Taiwan, China manufacturer, and Yuyang Technology, Fenghua High tech, and Sanhuan Group, a representative enterprise in Chinese Mainland, are all promoting the capacity expansion plan in a planned way.

Data source: compiled by Octopus Core

It is worth noting that although they are all expanding production capacity, the market for each manufacturer‘s efforts is different. Among them, Japanese and Korean manufacturers represented by Murata, TDK, and Samsung Electric have gradually withdrawn from low-end MLCC production capacity and started to focus on high-end automotive specifications, communication, industrial and other markets in order to improve profit margins due to their early start in the industry. Among them, in the field of automotive MLCC, Murata accounts for about 55%, TDK accounts for about 25%, and the combined market share of the two companies is as high as 80%, basically monopolizing the global automotive MLCC market. The products cover various aspects such as automotive power, autonomous driving, entertainment information systems, etc; In the field of communication MLCC, Murata accounts for about 40%, while Samsung Electric accounts for about 30%; Manufacturers from Chinese Mainland and Taiwan, China have a relatively low overall share in high-end MLCC.

Distribution of Main MLCC Factories in Murata Production Institute

Source: Murata

From a financial perspective, similar to the cyclical fluctuations of semiconductors, passive components experienced adjustments in 2022 after two consecutive years of significant growth in 2020 and 2021. After four consecutive quarters of inventory digestion, the overall industry reached a low point in Q1 2023 and saw another growth in Q2 2023.

In Q3, benefiting from the peak season of consumer electronics, the turnover rate of passive component manufacturers was improved, and most factories achieved month on month growth in business performance.

Changes in revenue of major passive component manufacturers in the past 12 quarters (international: US dollars; domestic: yuan)

Source: Wind

Specifically, in the international market, Murata achieved a revenue of 2.984 billion US dollars in 3Q23, a month on month increase of 20.39%. The net profit was 506 million US dollars, a month on month increase of 49.82%; TDK Q3 achieved a revenue of 3.75 billion US dollars, a month on month increase of 10.51%. The net profit was 266 million US dollars, a month on month increase of 168%; Sun Rust Electric achieved a revenue of 558 million US dollars in Q3, a month on month increase of 14.05%. The net profit was 17 million US dollars, a month on month increase of 176.52%; Guoju achieved a revenue of 910 million US dollars in Q3, a month on month increase of 5.60%. The net profit was 153 million US dollars, a month on month increase of 30.05%. It should be noted that although the above-mentioned manufacturers achieved growth in Q3, due to the significant decline in Q1 performance, the overall performance of the first three quarters was in a downward trend compared to last year.

In the domestic market, benefiting from the booming development of the domestic market, the overall performance of related manufacturers is better than that of international manufacturers. Specifically, Shunluo Electronics achieved a revenue of 1.344 billion yuan in Q3, a year-on-year increase of 28.59%. The net profit was 222 million yuan, a year-on-year increase of 94.57%. The revenue achieved in the first three quarters of 2023 was 3.676 billion yuan, a year-on-year increase of 15.55%. The net profit for the first three quarters was 478 million yuan, a year-on-year increase of 17.19%; Maijie Technology achieved a revenue of 839 million yuan in Q3, a year-on-year increase of 3.09%. The net profit was 83 million yuan, a year-on-year increase of 11.12%. In the first three quarters of 2023, the company achieved a revenue of 2.248 billion yuan, a year-on-year decrease of 6.55%. The net profit for the first three quarters was 184 million yuan, a year-on-year increase of 12.06%.

From the perspective of order situation, with the recovery of consumer electronics, manufacturers such as Murata, TDK, Guoju, Shunluo Electronics, and Maijie Technology have seen significant month on month growth in consumer electronics related revenue. In addition, benefiting from the rapid growth of new energy vehicles, manufacturers such as Murata and TDK have also shown a month on month growth trend in their revenue contribution from on-board related capacitors and inductors. However, in the industrial, home appliance and other markets, the current situation is still very weak, and it is expected that demand will recover for some time.

In terms of inventory, due to a large market share, in order to ensure supply, the inventory amount of Japanese manufacturers such as Murata Manufacturing Co., Ltd., TDK, Sun Power, KOA, and Kyocera, which are among the top in the industry, has been showing a slight increase in recent years; However, Taiwan, China manufacturers represented by Guoju, Huaxinke and Taiqingke and Chinese Mainland manufacturers represented by Shunluo Electronics and Sanhuan Group have been in strict inventory management since 2022Q2 due to decreasing orders due to the influence of the market.

Changes in inventory amounts of major passive component manufacturers in the past 12 quarters (international: US dollars; domestic: yuan)

Source: Wind

Overall, as of now, the passive component industry has emerged from its lowest stage and is in a slow recovery period. Among them, companies such as Guoju and Taiqingke believe that the inventory adjustment for clients will end in the second quarter of this year and are expected to experience a recovery in the second half of the year. Manufacturers represented by Murata stated that demand is currently improving quarter by quarter, and the company is preparing to increase production for the industry‘s recovery period.

Impact: Short term related passive component category products may cause price fluctuations

At the time of the overall recovery of the industry, Murata suddenly suffered from the unexpected disaster of the earthquake. Although he is currently sharing information and cooperating with partner companies to minimize the impact, overall, it will inevitably have a certain impact on the company‘s daily business development and subsequent finance.

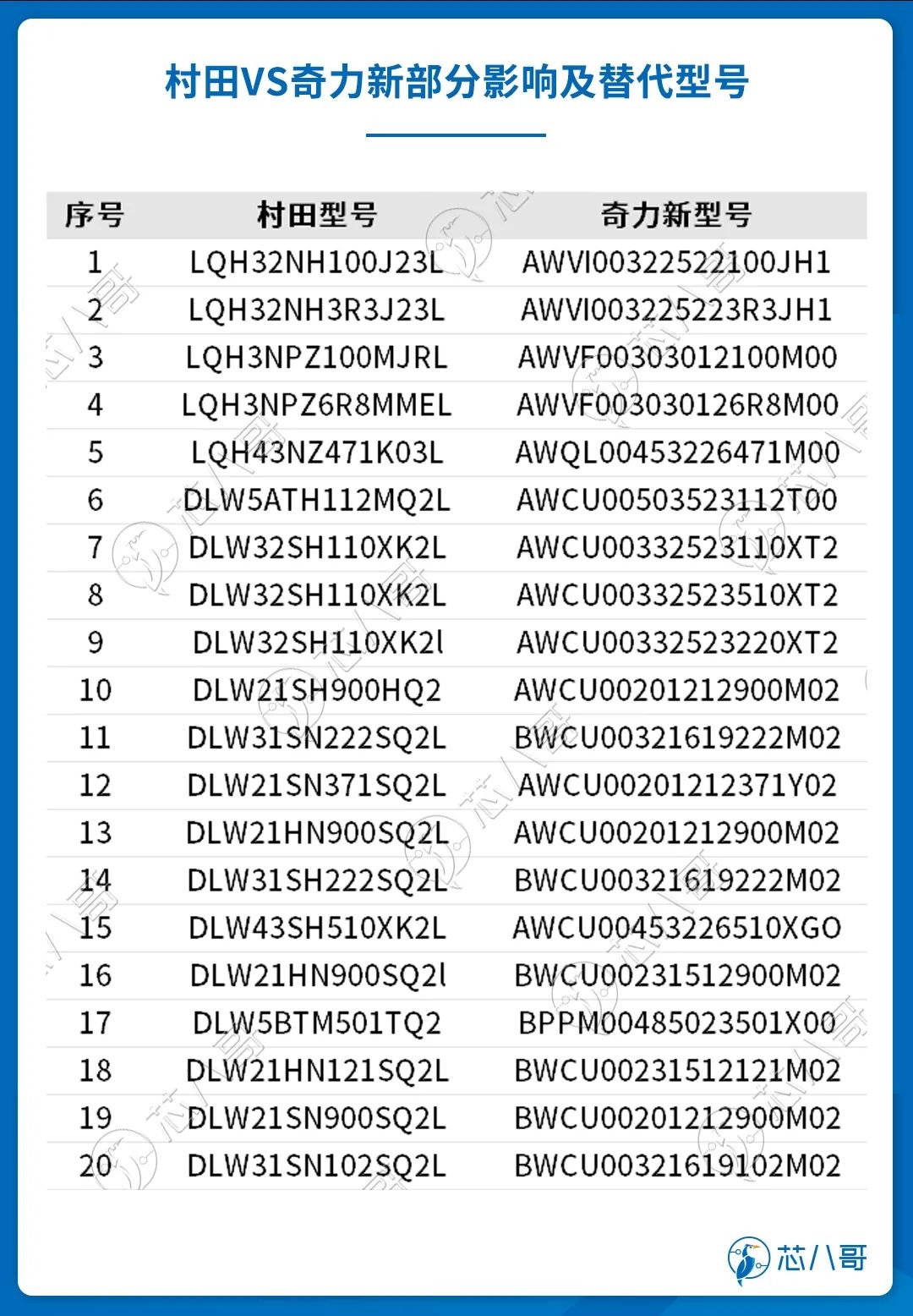

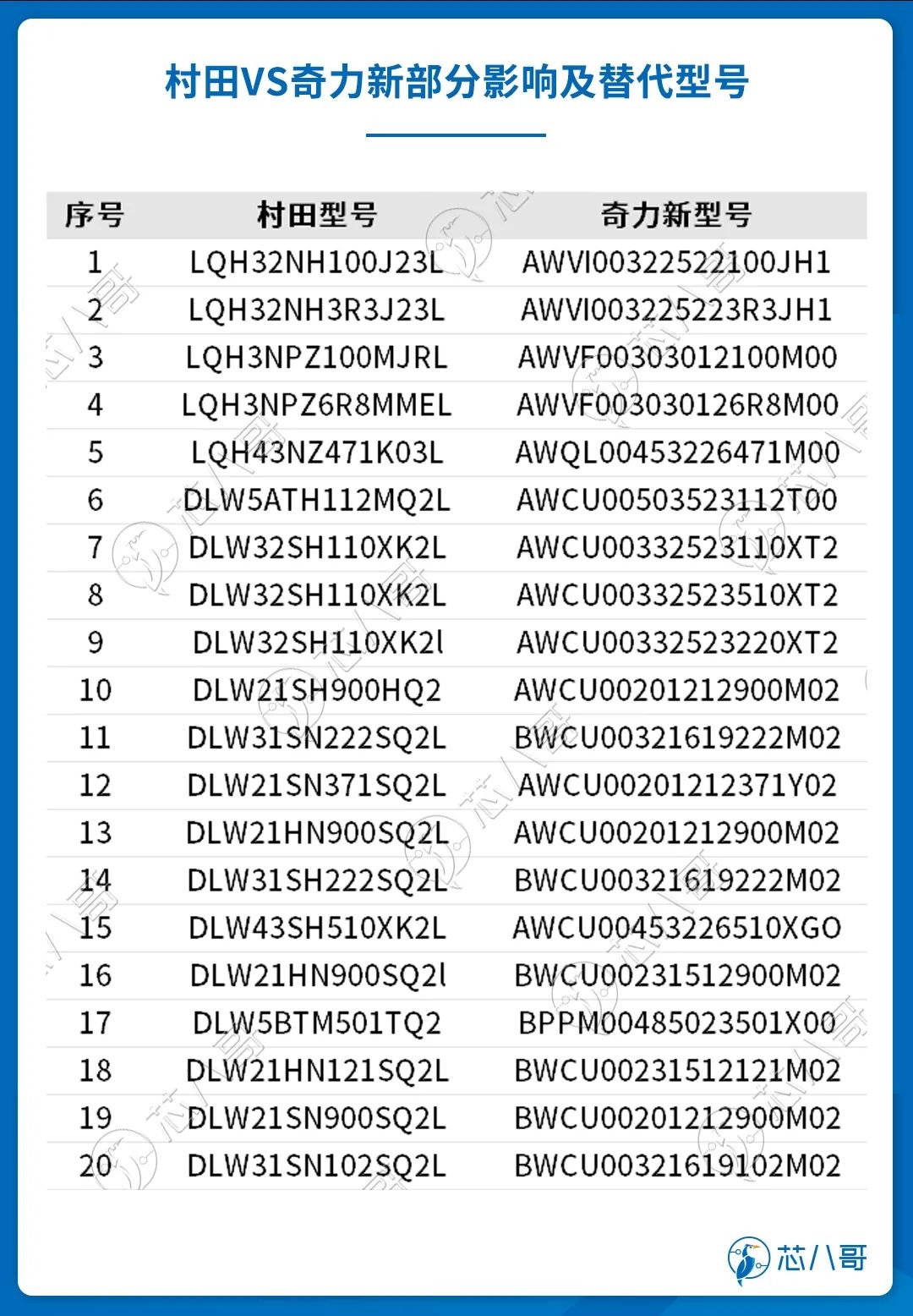

It is understood that the production of inductors (coils) and other products is mainly produced by the Kozumi Murata Manufacturing Institute (Kozumi cho, Ishikawa Prefecture), which has not yet resumed production. The LQH series inductor products have a significant impact, including specific models such as LQH2H, LQH32, LQH3N, LQH43, LQH44, LQH55, LQH5B, LQH66, NFZ32, NFZ5B, etc. Industry supply chain insiders have stated that currently, Murata‘s products in this series cannot be referenced for delivery dates, and new orders cannot be placed for the time being.

From a usage perspective, according to Murata‘s official website, there are over 1300 models designed for the LQH series products, of which over 500 are AEC-Q200 certified products mainly used in the fields of automotive powertrain/safety equipment (206 models) and automotive entertainment/comfort equipment (297 models), and the remaining 700 are civilian equipment products.

Due to force majeure caused by the earthquake, Murata will experience a large number of contracts that cannot be fulfilled, and this period will continue until mid May. Although his own losses have already been incurred, in order to minimize customer losses as much as possible, Murata has also provided an alternative solution for third-party manufacturers of products produced by the cave water factory.

According to the supply chain, Murata‘s designated alternative manufacturers this time mainly include Taiqingke and Qilixin in Taiwan, China. Among them, Taiqingke was established in 1992, with its headquarters in Taoyuan, Taiwan, China, China, focusing on the development, manufacturing and sales of magnetic materials and inductive components. At present, the company has two manufacturing bases in East China. In automotive applications, the company‘s products mainly include information systems, TPMS, parking assistance, HID/light-emitting diodes, head up displays, DC-DC converters, etc. Regarding the transfer of orders from Murata, Taiqingke stated that it has indeed received many inquiries from customers recently. Compared to the last major earthquake, the inductance used in this transfer belongs to a special type, which has a significant impact. Taiqing Science and Technology has prepared materials and is striving for orders. It is expected to start shipping by the end of February at the earliest.

Qi Li Xin Company was founded in 1972 as a professional manufacturer and service provider of inductance components, with production and sales service bases covering Taiwan, China, Asia, Europe, and the United States. Its main customers include international giants such as Microsoft, SONY, Samsung, PACE, Panasonic, Nvidia, Foxconn, Harman Becker, Technicolor, Pantech, Guangda, Renbao, Wistron, etc. In the automotive field, Qili‘s new inductance products are numerous and widely used in automotive air conditioning systems, car lights, advanced driving assistance systems, onboard computers, information entertainment systems, network communication modules, GPS/DVBT/BT/Wi Fi/FM/GSM, central electronic systems, and other fields. For Murata‘s transfer order, Qilixin stated that it has received many inquiries from customers since last week, and the company will do its best to assist clients with their needs. Special specifications of products will accelerate certification.

Data source: compiled by Octopus Core

It is interesting that TDK and Sunpower, both local Japanese manufacturers of inductors, are not included in the designated replacement list. However, as a direct competitor, TDK can provide a variety of products for the V2X, in car network, powertrain, safety and comfort of automobiles, while Sunpower can also provide numerous inductance products for the control, safety, body, information and other fields of automobiles. It is expected that in addition to Taiqing Science and Technology and Qili New, TDK and Sunpower will also benefit from Murata‘s shutdown and conversion in the short term.

For the industrial chain, the impact of the current shutdown of Murata on upstream suppliers is minimal, as the reduced procurement of raw materials such as magnetic powder, magnetic powder cores, and electrode materials by Kongshui Murata Manufacturing can be fully absorbed by the new orders from Taiqingke and Qili due to the conversion effect; For downstream end customers, consumer electronics represented by mobile phones are currently experiencing a mild recovery, while industry is temporarily in a state of destocking. The high demand for automotive electronics has been continuing. Therefore, for mobile phone and automotive end manufacturers, in order to ensure supply, they will inevitably increase their stock levels in other manufacturers in advance. When the supply-demand balance is disrupted, it may drive the short-term price increase of inductors, especially automotive inductors with high entry barriers.

Source: Huajing Industry Research Institute

In addition, against the backdrop of ongoing trade frictions between China and the United States, mobile phone manufacturers represented by Huawei, Xiaomi, OPPO, VIVO, as well as new energy vehicle companies represented by BYD, NIO, Ideal, Xiaopeng, etc., have increasingly strong demands for independent and controllable key components. In this context, passive component manufacturers in mainland China are actively expanding production, following the trend of domestic substitution of key components, and are expected to benefit to some extent from Murata‘s shutdown and conversion of orders.

For example, Shunluo Electronics in Chinese Mainland has been able to provide the market with PoC inductors, inductors for high-frequency signal lines, inductors for general signal lines, inductors for power lines, inductors for coupling circuits and other products in the automotive field. When talking about Murata‘s conversion, Shunluo Electronics stated that the automotive field is an important new application area that the company has been laying out for many years in advance. Currently, alternative projects for major customers are being promoted, and the company will seize the opportunity and actively connect with customers; And Maijie Technology‘s customers mainly include ZTE, Huawei, Lenovo, Xiaomi, etc. Currently, the company can also provide various integrated inductors, precision wound inductors, common mode inductors and other products to the automotive industry; Of course, in addition to listed companies, some non listed companies in China have also developed very well in the field of inductors. For example, Kodak‘s automotive grade products have also entered the supply chain systems of many Tier 1 manufacturers, as well as well-known OEMs such as Xiaopeng, Ideal, and NIO.

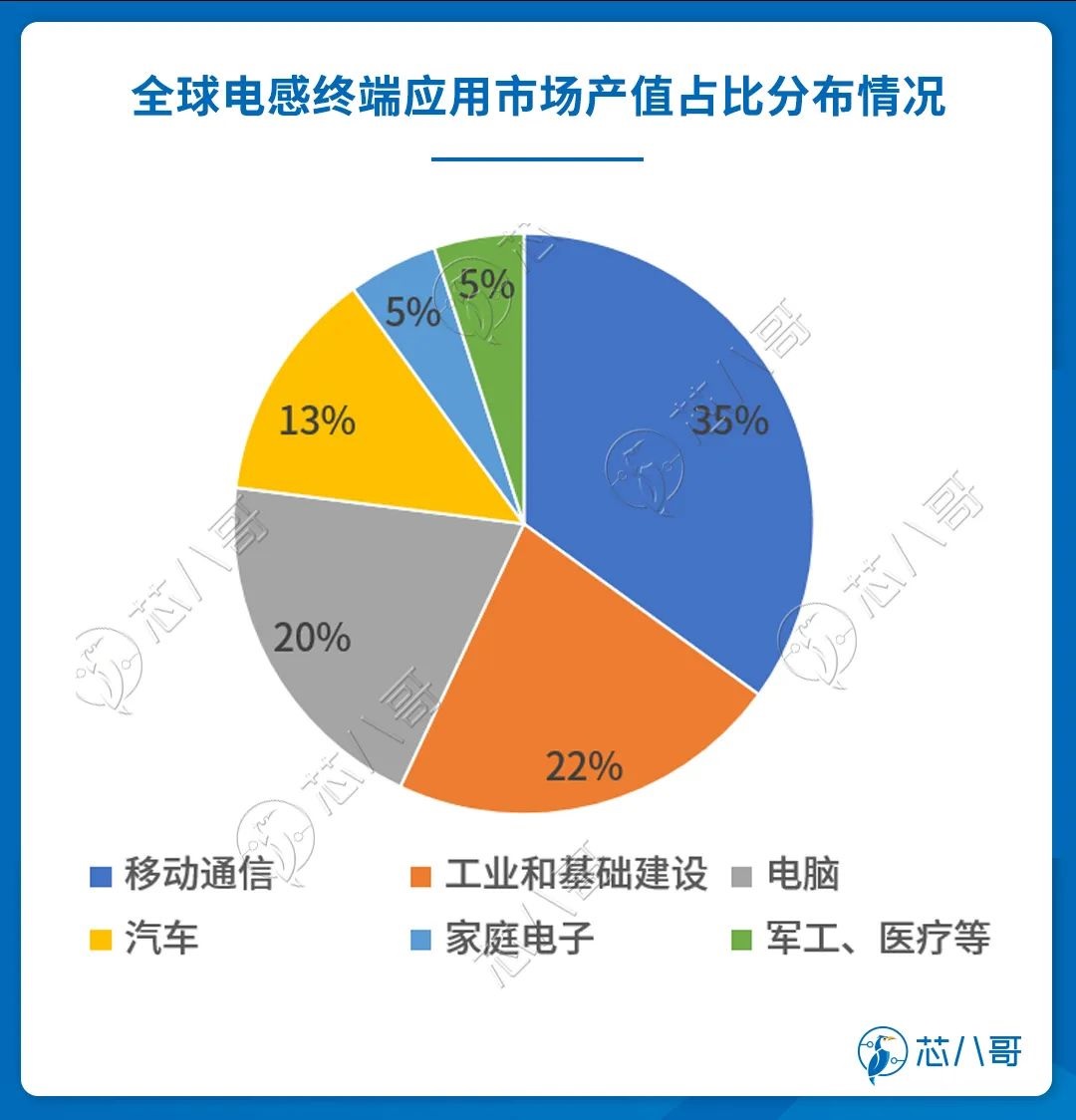

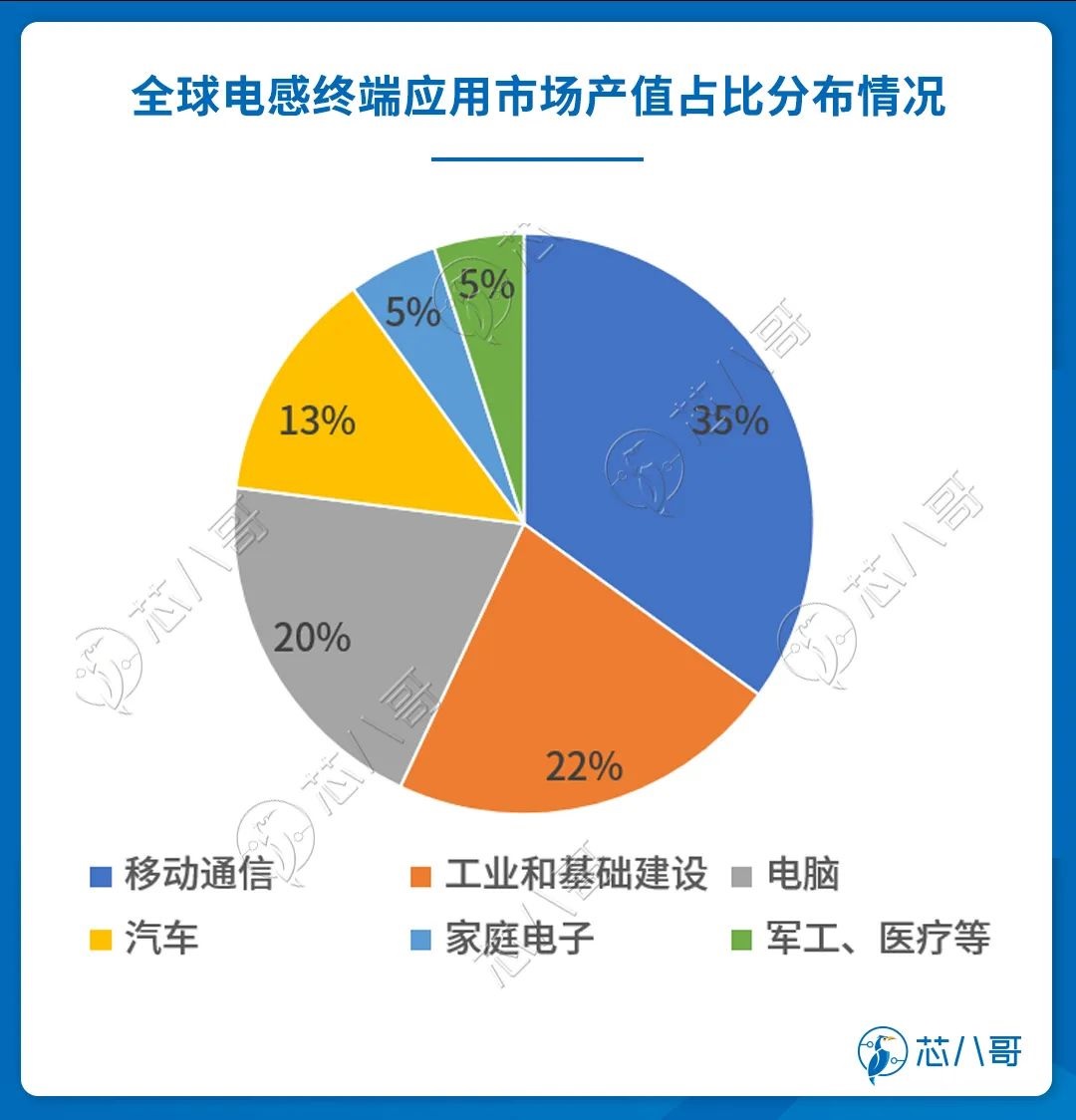

Inductors are widely used in mobile communication, automotive, industrial and other fields, with the largest market share in mobile communication, while the growth rate in the automotive and new energy sectors is relatively fast. In terms of value, inductors in fields such as automobiles, industry, and healthcare belong to high-end products with extremely high added value.

The cave water factory that produces inductors and other products in Murata has been severely damaged this time, not only affecting its daily operations, but also changing the supply and demand situation of the entire inductor, especially the car standard inductor. Perhaps it will bring an opportunity for a short-term price increase to the industry.

In the long run, passive components, especially high-end passive components, are still mainly dominated by large Japanese and Korean manufacturers. However, China has the most leading enterprises in communication, mobile phones, automobiles, and other terminals. Considering future supply chain security and convenience, domestic passive component manufacturers are expected to usher in a golden period of development with the support of terminal manufacturers.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |